How SBA Loan Officers Can Use Loan Data to Find More Deals

The best business decisions are made when experience and instincts are combined with data. Targeting high potential niches to increase SBA loan origination volume is no different.

In the SBA lending industry, we are fortunate that a wealth of data is made publicly available by the Small Business Administration. This information is published quarterly and, when analyzed strategically, can help you shape a data-backed lending strategy that will set you up for success.

So how can you take this wealth of data to make better strategic decisions and ultimately find more deals? This article covers some of the key strategies lenders use to put this data to use.

Methodology for Data Analysis

We’ll be using the SBA Atlas to power our data analysis throughout this article. This free tool allows lenders to quickly build custom dashboards of SBA loan data filtered by time period, region, and industry.

The data points we’ll focus on include:

- Loan Dollar Volume Analyzed by Industry & Location

- Charge-off Rates Analyzed by Industry & Location

We’ll comb through this data in different areas to understand the specific characteristics of lending landscapes across the nation. The insights we can draw from the data highlight opportunities for lenders looking to close more deals in specific regions. To follow along, filter the Atlas dashboard for your region and apply the same strategic analysis to better understand your local lending landscape as you develop more targeted approaches to growing your SBA portfolio.

Find Industry Outliers In Your Region

As a lender it is important to know which industries have historic success with the 7(a) program and which ones are poised for continued growth. However, as a regional or local lender, it isn’t enough to just look at the top industries nationwide. Each community or region will likely have industries that have disproportionately higher or lower loan volumes in the area than the national average. These outliers may indicate opportunities for lenders to focus on industries that are more prevalent in their region and have a track record of being successful in the 7(a) program, while also being aware of what the local competition is doing.

Using these insights, lenders can create more efficient direct outreach and marketing campaigns tailored regionally to prevalent industries within a specific footprint. Local lenders may want to build a presence and referral network in one of these outlier industries to grow their SBA portfolio, especially if that industry is sizable and growing in the area.

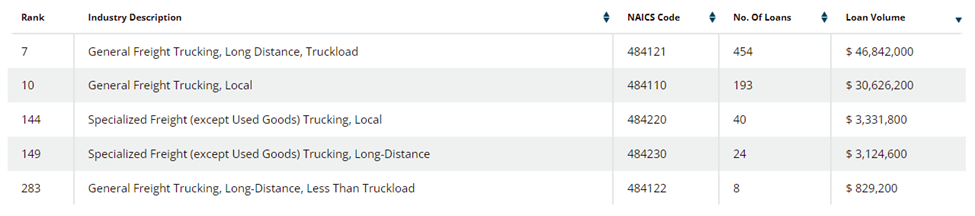

For example, let’s look at the trucking industry in Ohio from FY 2020 to FY 2021. $84,753,800 was authorized to trucking-related businesses in Ohio during that time. It accounted for 4.3% of the Ohio’s total 7(a) loan volume during this same period, while the trucking industry only makes up roughly 2% of the total loan volume nationwide during this same period.

Additionally, looking at the dollar volume rank of those trucking-related industries below, 2 of them fell into the Top 10 industries overall for Ohio from FY 2020 – FY 2021.

SBA 7(a) Loan Volume for Trucking-Related Industries – Ohio (FY 2020 – FY 2021)

Nationwide, General and Specialized Freight Trucking NAICS Codes all rank outside the top 15 by total dollar volume authorized. For Ohio lenders, it’s important to know that there is such a strong, unique demand right in their backyards. Lenders may want to focus on serving this high demand by specifically tailoring their outreach to trucking related businesses or partners.

Next, we’ll analyze another state with concentrated industry success: Pennsylvania. Based on SBA data, we can conclude that Pennsylvania is one of the brewery hotbeds of America. How?

In FY 2020 – 2021, Pennsylvania breweries accounted for 8.7% of nationwide 7(a) loan dollar volume authorized to the brewery industry. Given that the state of Pennsylvania only accounts for 2.6% of 7(a) loan dollar volume, there is a disproportionately high amount of brewery loans conducted in the state.

In that same time frame, breweries ranked as the 40th industry for loan dollar volume nationwide with $273.3MM, but in PA the industry ranked #12.

Breweries Received $23,658,700 in SBA (7A) Funding in PA from FY 2020 – FY 2021

As a lender in PA, it would be important to know that your lending footprint includes one of the nation’s hubs for breweries. You may find that this can be an industry you can target and build a brand presence in, to help grow overall loan volume.

Analyzing the data from the SBA Atlas can help you to determine these kinds of industry concentrations in your lending area. Some of the results may surprise you.

Discover the High Growth Areas in Your Region

It’s normal for areas of population and small business growth to continually shift throughout the country and/or in local regions. As a lender, it is important to keep a pulse on where these shifts are taking place and which areas are up-and-coming small business growth areas.

One way to stay informed is to identify regions where SBA volume is experiencing significant growth. Using this data will help to inform you of the local counties that are primed for strong small business growth to position your institution as one of the leading lenders in the region.

With the SBA program growing year-over-year, it is no surprise that many states are seeing significant loan volume growth. However, as a lender it is important to know where this growth is coming from so you can hone-in on the high-growth regions.

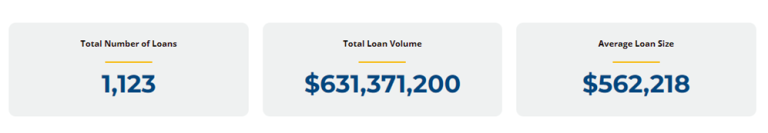

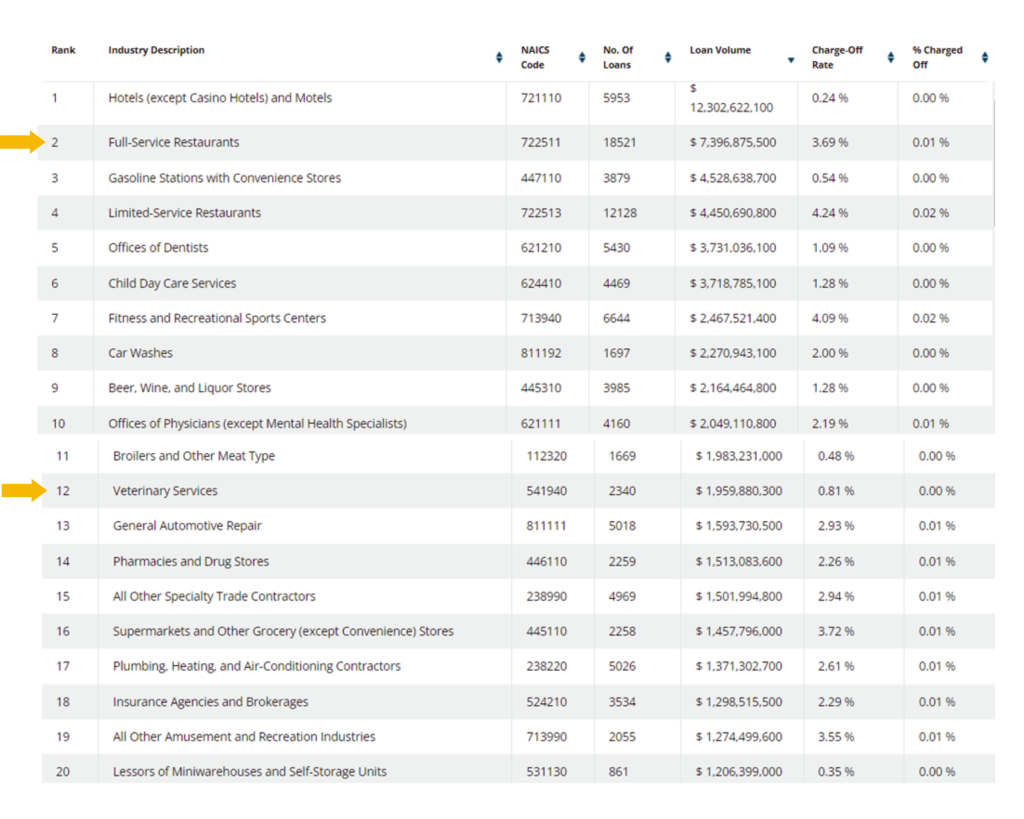

Let’s take a look at a state that has grown significantly in the past few years, both in population and SBA loan volume. From 2019 – 2021, North Carolina’s loan dollar volume grew 64%, reaching just over a billion dollars in 2021, up from $631.4MM in FY 2019.

FY 2019 North Carolina SBA 7(a) Loan Data

FY 2021 North Carolina SBA 7(a) Loan Data

Not only has the overall volume significantly increased, but the counties in the state this volume is coming from is shifting as well. The below tables compare the top 10 counties in North Carolina in FY 2019 and in FY 2021. The two major population centers of Mecklenburg and Wake counties have only grown 17% and 47% respectively.

Top Counties in North Carolina FY 2019 Based on Loan Volume

Top Counties in North Carolina FY 2021 Based on Loan Volume

This may seem like significant growth until we look at some of the smaller counties on the list that are experiencing sizable population booms. For example, during this same period:

- Cumberland county grew 170% by dollar volume.

- Durham grew 145%.

- A newcomer to the top 10 list in 2021, Forsyth county, grew a whopping 396%.

Understanding which states, counties or regions have a large number of new or expanding small businesses can help you be more targeted in your marketing efforts.

Local lenders certainly have the advantage over national lenders when applying this strategy. Both local and national lenders keep a pulse on population growth, however, population data is harder to track and update than SBA data. Rapid economic expansion and overall development are more and more difficult to get ahead of. By the time it’s transformed a region, lenders aiming to appeal to small business owners are behind the curve.

As a local lender, you know which areas in your state are garnering buzz. Pair your knowledge of upcoming and expected development with published population data to identify areas with high potential for small business growth in the near future.

By targeting these smaller counties that are experiencing major increases in small business lending activity, you can be one of the first established lenders in a region that has a large demand for SBA loans, with potentially less competition.

Understand Which Industries Are More or Less Risky in Your Region

Not all industries are created equal when it comes to how likely that business may be to default on its loan. Understanding which industries have a higher propensity of being charged off can help you target industries that have a higher likelihood of being approved by your organization’s credit team.

Charge-Off data is one of the primary risk metrics lenders can use to determine how likely a borrower is to make payments throughout the life of the loan based on the industry’s historical data. Loans are classified as ‘charged off’ by the SBA when there is no longer an expectation that the borrower will continue making payments. This statistic is not to be confused with default rate. Loans enter default when the borrower ceases to make payments on their loan for an extended amount of time. Therefore, if a loan is considered to be in default by the lender, it happens before the loan is ‘charged-off’ by the SBA.

It can take years for the SBA to consider a loan ‘charged off’. Therefore, it is more valuable to analyze charge off data over a longer period of time.

Comparing the percentage of charged off loans by industry can help you get a sense of which industries may be higher and lower risk to lend to. There are many other factors that go into determining the riskiness of an industry, but data gleaned from historical charge-off rates will provide you with one of the key data points.

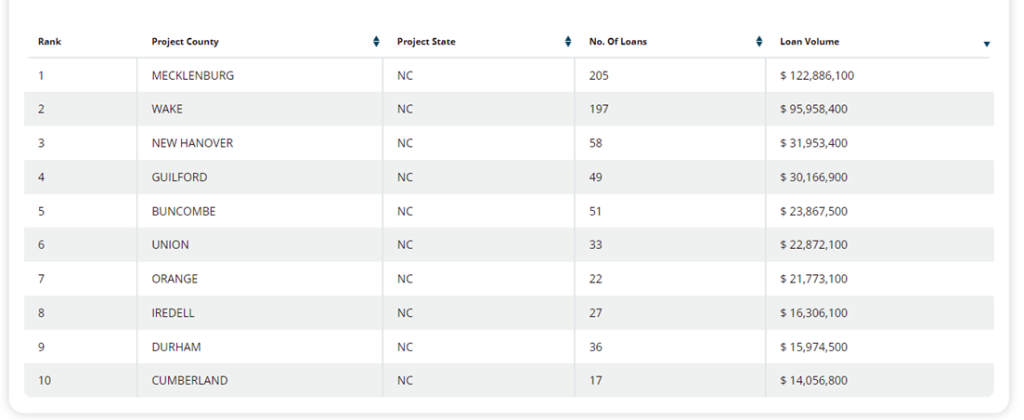

For example, when looking at all 7(a) loans authorized from 2015 – 2020 nationwide, 3.69% of all the loans units in the “Full-Service Restaurant” industry were charged-off by the SBA (683 of the 18,521 loans), compared to just 0.81% of all loans in the “Veterinary Services” industry during this period (19 of the 2,340 loans). The below table, which shows the charge-off rates for the top 20 industries nationwide, highlights how different industries can have vastly different charge-off rates.

Charge-Off Rates for the Top 20 Industries Nationwide By Loan Volume From FY 2015 – FY 2020

It is also important to note that the riskiness of a specific industry may vary region to region. Therefore, it is beneficial to know the charge-off rates for both the nation as a whole, and your specific region.

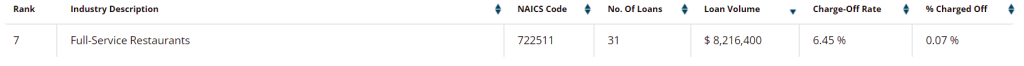

Like previously mentioned, the national charge-off rate for “Full-Service Restaurants” from 2015 – 2020 is 3.69%, however this charge-off rate can vary depending on the region you operate in. For example, in South Dakota the charge-off rate of Full-Service Restaurants during the same time period is 6.45%, almost double the national average.

Charge-Off Rate for "Full-Service Restaurants" in South Dakota From FY 2015 – FY 2020

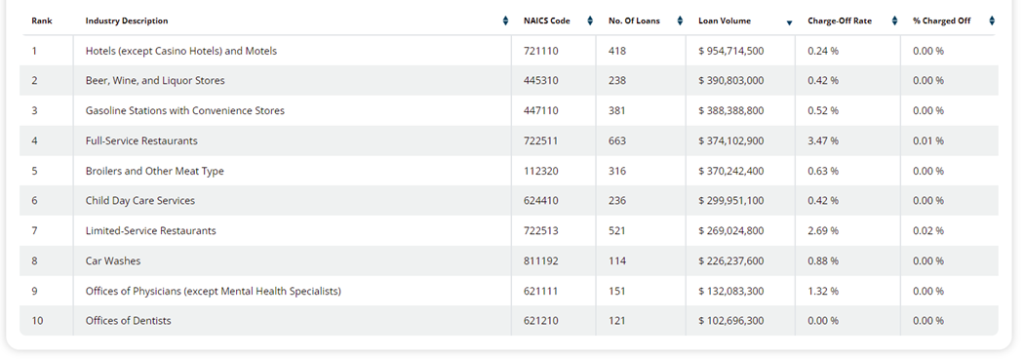

On the flip-side, the charge-off rate for Full-Service Restaurant loans in Georgia is only 3.47%, lower than the national benchmark of 3.69%. Let’s take a closer look at how charge-off rates vary by industry in the state of Georgia.

Charge-Off Rates for the Top 10 Industries in Georgia By Loan Volume From FY 2015 – FY 2020

In Georgia, there are 7 industries within the top 10 also that have < 1.0% charge-off rate. As a lender, identifying these high volume, low charge-off rate industries in your region can help you be more targeted in the industries you pursue.

Note that charge-off data in the SBA Atlas is available only to Premium users, which is reserved for Windsor Advantage’s customers and partners.

Explore the World of SBA Lending Through The Lens of Data

There is no single way you must look at SBA data in order to effectively leverage it for your lending strategies. Although the strategies in this article provide a framework to begin leveraging SBA loan data in your research, your data interpretation will inevitably be shaped by your own insights and experiences. Together, pairing empirical evidence with your instinct is your unique advantage to developing a winning SBA lending strategy.

We created the SBA Atlas tool to empower your teams with easy access to this valuable data, enabling you to filter, compare, and analyze data how you see fit to make more informed and strategic decisions. Click the link below to register for a free SBA Atlas account and begin exploring the world of SBA lending trends.

About Windsor Advantage

Windsor Advantage provides banks, credit unions and CDFIs with a comprehensive outsourced SBA 7(a) and USDA lending platform.

Since 2010, Windsor has processed more than $2.8 billion in government guaranteed loans and currently services a portfolio in excess of $2 billion (as of December 31, 2021) for over 100 lender clients nationwide. With more than 150 years of cumulative SBA lending experience, cutting edge technology, rigid controls and consistent processes, Windsor is uniquely qualified to assist any size lender with implementing a thoughtful and profitable government guaranteed lending initiative.

The Company is headquartered in Chicago, IL with offices in Indianapolis, IN and Charleston, SC.

Explore More Resources for Lenders:

PDF Download: Overview of SBA Loan Guaranty Programs for FY 2024

New to the SBA space? In addition to the popular 7(a) Loan Program, SBA offers a number of financing programs for SMB owners dependent on eligibility. The below chart was recently shared by SBA. This chart outlines a high level overview of the latest eligibility requirements and loan proceed amounts available for each SBA financing

2023 SBA Secondary Market Premiums: Market Outlook

in partnership with Ben Clark, FHN Financial and Matt Saslawsky, Windsor Advantage GGL Sales Associate In this report: key themes of SBA secondary market performance in 2023, factors shaping the outlook for 2024, and the ripple effect of recent SOP changes that lenders should watch. I. Overview of 2023 SBA Loan Secondary Market Performance: SBA

SBA Procedural Notice 5000-855070

Download SBA Procedural Notice 5000-855070, regarding the adoption of SBA Alternate Size Standards, effective March 5, 2024.