Over the last year, legislation has been passed to support businesses negatively impacted by the pandemic and to provide benefits to SBA borrowers. One significant piece of legislation was Section 1112 of the CARES Act passed in March of 2020, which provided payment relief to small businesses. Section 1112 provided $17 billion of “debt relief payments”, also known as “covered payments”, to SBA borrowers by subsidizing their principal and interest payments for up to 6 months. This was a critical lifeline to businesses that were seriously impacted by the COVID-19 pandemic.

However, there has been some confusion on this topic floating around among borrowers and lenders alike. Several revisions to Section 1112 have introduced varying rules for certain businesses and continues to muddy the waters in terms of lender communication with borrowers. In this article, we will breakdown the latest revisions to debt relief payments and what these mean for lenders.

The Latest Revisions Explained

On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act (Economic Aid Act) was signed into law. In addition to reintroducing the Paycheck Protection Program, the Economic Aid Act enhances and extends provisions of Section 1112. The new Act specifically allocates an additional $3.5 billion to the SBA to provide debt relief payments, which will be available to borrowers until funds expire. New and existing 7(a), Express, Export Working Capital, International Trade and 504 borrowers are eligible to have portions of their principal and interest payments covered under the Economic Aid Act.

The SBA initially provided guidance on how this new payment relief should operate on January 19, 2021 (Procedural Notice 5000-20079) but revised these rules on multiple occasions. Here is a brief explanation of subsequent Procedural Notices related to Section 112 that followed:

- February 12, 2021 (Procedural Notice 5000-20093) – Guidance on Establishing Maturities of New 7(a) Loans Eligible to Receive Payments under Section 1112 of the CARES Act on or after February 1, 2021.

- February 16, 2021 (Procedural Notice 5000-20095) – Adjustment to Number of Months of Section 1112 Payments in the 7(a), 504 and Microloan Programs Due to Insufficiency of Funds.

- March 12, 2021 (Procedural Notice 5000- 806780) – Guidance on 7(a) and 504 Loans with Monthly Installments in Excess of $9,000.

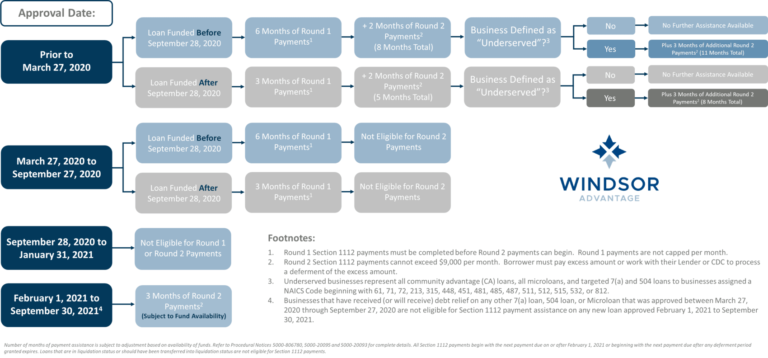

Here is an infographic that provides a brief snapshot of which borrowers are eligible for which types of debt relief payments:

What Do These Revisions Mean for Lenders?

- Program Updates to Covered Periods May Change – As a lender, one of the most important things to recognize is that the rules and regulations around debt relief payments should be treated as a fluid situation. As we have already seen, the SBA can adjust the dollar amounts, length of time and borrower eligibility.. The SBA is working within a limited budget and is doing its best to provide the needed relief to those businesses most in need.

- Lenders Must Take Action to Ensure Borrowers Receive Payments – Lenders must request these SBA debt relief payments for their borrowers in order for their borrowers to receive the benefits. Lenders should refer to the above visual to create a list of eligible borrowers internally within each of the various categories. It is the lender’s responsibility to submit the specific dollar amount of debt relief payments to the SBA on behalf of their borrowers, based on their eligibility. If a lender is working with a Lender Service Provider, such as Windsor Advantage, the LSP can help manage this process.

- Understand Each Borrower’s Unique Situation – By monitoring cash flow situations closely during a covered period, borrowers can learn responsible ways to ensure they will be prepared to resume making payments once their covered period ends. Not every borrower’s situation will be the same, so be sure to review interim financials along the way. This can eliminate any surprises if certain borrowers have taken on any additional liabilities that could impede future payments, as well as help your credit team be on the lookout for borrowers that might need consideration for a payment deferral once their covered period ends.

- Consistent Borrower Communication is Critical – One of the best things you can do as a lender in the current environment is to simply keep a line of communication open in a regular, proactive way. Be sure to overcommunicate any new updates as they are released and have an internal process established.

- Encourage Borrowers to Consult Tax Professionals – As always, it’s important to encourage borrowers to consult a trusted tax attorney or CPA regarding any questions on business tax preparation. The IRS provided tax guidance through The Consolidated Appropriations Act, 2021, P.L. 116-260, which provides that debt relief payments are not included in the borrower’s gross income. In addition, notice 2021-6, issued on January 19, waived Form 1099-MISC reporting requirements for these payments.

By implementing these strategies, you can improve relationships with your clients and help set them up for success. In critical times such as now, it is important to be in contact with trusted partners who can provide both your institution and your clients the most up to date information and professional advice. Windsor Advantage remains in contact with our clients, updating them on all the latest developments from the SBA and how this will affect Government Guaranteed Lending operations.

Contact Windsor today if you are interested in learning more about how our team can connect with your institution to pave the way for SBA lending success in 2021.

"*" indicates required fields

About Windsor Advantage, LLC

Windsor Advantage provides banks, credit unions and CDFIs with a comprehensive outsourced SBA 7(a) and USDA lending platform.

Since 2010, Windsor has processed more than $2.8 billion in government guaranteed loans and currently services a portfolio in excess of $1.8 billion (as of December 31, 2020) for over 100 lender clients nationwide. With more than 150 years of cumulative SBA lending experience, cutting edge technology, rigid controls and consistent processes, Windsor is uniquely qualified to assist any size lender with implementing a thoughtful and profitable government guaranteed lending initiative.

The Company is headquartered in Chicago, IL with offices in Indianapolis, IN and Charleston, SC. For more information, call (317) 602.6648 or visit www.windsoradvantage.com.